Iraq has ambitious plans to develop its huge southern oilfields – potentially the world’s biggest source of new oil over the next few years – and few oil firms dare risk being barred from such a bonanza by angering Baghdad.

But increasingly, some executives say, Kurdistan’s potential is also coming up in boardroom discussions, as sluggish output, red tape and infrastructure bottlenecks in the south take some of the shine off the central government’s oil program.

Oil majors are now waiting on the sidelines, watching the outcome of Exxon’s balancing act between Baghdad and Arbil, the northern capital. France’s Total is the latest company to provoke Baghdad’s ire by acknowledging interest in Kurdistan.

“What companies are trying to do is get to the point where they are investing in the north and the south,” said one industry source working in Iraq……Firms have experienced problems getting visas for contractors and security staff, delays in bringing in armored vehicles and holdups securing operating licenses. Such hassles make Kurdistan’s offerings look more tempting by comparison.

“Every delay we face cuts off a significant part of the internal rate of return,” said one oil company source. “Sometimes I wonder if we picked the wrong region.”

This is some interesting business going on in Iraq. Oil companies are playing a risky game in Iraq, and yet they are the actors that will more than likely drive Iraq to ‘pull it together’. It also looks like Exxon Mobil is leading the charge in this game as well.

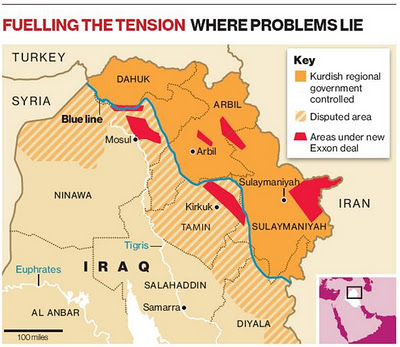

I say this, because the divisions in Iraqi parliament/central government, along with corruption, is causing oil companies to seek safer and more stable leadership/relationships to do business with in order to keep extracting and shipping oil. For example, Exxon has signed contracts both in the North and the South, and it looks like they are starting to lean more towards moving north with the hopes that this will send a message to parliament. Of course parliament reacted by saying they cannot bid on any more contracts in the south.

The other area of interest with this, are the contracts signed in the disputed areas. Specifically the area near Mosul, which is the second largest city in Iraq. I could see Exxon having all sorts of problems in that region unless some serious deals were made, and I was curious as to what the motivation was? Perhaps the clues are in the state of affairs within the city itself. Check this quote from an interview with Mosul’s governor?

Mosul is an agricultural and oil region. However, it cannot properly and sufficiently use Iraq’s oil revenues. Mosul is also uncomfortable with the recent agreements between foreign oil companies and Arbil to extract oil from Mosul’s soil. For instance, Exxon-Mobil signed a contract with the KRG despite the fact that the site it will explore for oil is in Mosul. Nujaifi is holding talks with Exxon-Mobil and the KRG to resolve this problem. In addition, under the Iraqi constitution, Mosul should get 11 percent of Iraq’s oil revenue. However, it receives only 2 percent. According to Nujaifi, if the oil bill is not adopted and the oil revenues are not distributed evenly by the provinces, a political crisis will erupt. The poverty rate in Mosul is 23 percent, whereas it is 3 percent in the KRG. Nujaifi notes that the rising tension along the borders of Mosul is creating tension for them as well. As the KRG becomes more popular, it is impossible to explain the recent state of backwardness in Mosul.

I highlighted the key parts in this quote, and I think that is most significant. With poverty as high as it is, and a neighbor like KRG enjoying the good life, who do you think Mosul will want to do business with? Especially if Iraq is only giving Mosul 2 % of Iraq’s oil revenue. They are definitely getting the short end stick in this deal, and either the South pays up, or Mosul will probably join the Exxon party.

Also, the news of Kurdistan signing a deal with Turkey for a new pipeline that would completely shut out Baghdad is definitely some news to talk about here. That would mean they would have a way to capitalize on oil extraction without paying Baghdad. They could possibly bring cities like Mosul into the mix with this pipeline, and especially if Mosul can capture a better deal.

On Sunday, Iraqi Kurdistan unveiled an agreement to sell oil through Turkey into the international markets, thereby leaving Baghdad completely out of the loop. The Kurdish oil minister Ashti Hawrami said Iraqi Kurdistan will construct a huge 1 million barrel per day pipeline over the next 12 months through which oil and gas will be carried through Turkey.

“We envisage the building of a new pipeline taking Kurdistan’s oil, particularly the heavier component part to Cihan,” Hawrami said at a conference with Taner Yildez, the Turkish energy minister.

Baghdad believes such an arrangement contravenes Iraqi laws, while Kurds assert they can sign any contract regarding their natural resources according to the terms of the constitution.

Oil fields like this also provide jobs to the locals and infuse money into the local economy. Security will be crucial–which means local security companies will be a huge player in this. (although if you look at how MEND operates in Nigeria, you could see the same thing happening in Mosul with insurgents) The question here is would Baghdad send the troops to protect these oil fields? lol Probably not, unless they are included in the oil deal. That is where this get’s interesting, and I am sure criminal groups and insurgents are looking at how they could use this to their advantage.

The other thing to look at is if Exxon and other oil companies have another pipeline they can use, that is being managed by a government that knows what it is doing and is stable, then I could totally see how this would be a better bet for those companies. This is also another signal to Baghdad that ‘hey guys, if you come together and square away your house, then you too can enjoy the same prosperity as the Kurds’.

Or, the Iraqi government can try to exert influence or pull some military moves up north, but good luck there. lol The Peshmerga and terrain will dictate otherwise.

So we will see how it goes. My guess is that Exxon and others will continue to play the North against South in order to keep extracting. They will keep these two players of the country competing for these companies and their capability. That back and forth interaction, might be the kind of business that will force the country to square itself away in order to finally realize their oil extraction goals. The alternative is to be driven apart.

There is a lot of money in the ground, and if Iraq wants it, it will have to do business with the companies that know how to get it out and into the market. That takes compromise and leadership, and a divided parliament and corrupt government in the south will only force companies to take the path of least resistance. –Matt

Analysis: In Iraq, oil majors play north versus south

By Patrick Markey and Peg Mackey

Thu Apr 5, 2012

In the weeks before Iraqi Kurdistan revealed that Exxon Mobil had signed up to explore for oil there, executives at rival Shell faced a dilemma over whether or not to join the U.S. oil major in its foray north and risk angering Baghdad.

The fields in the autonomous region offered rich potential, an easier working environment, better security and attractive contracts. That seemed a winning combination for smaller oil companies already working there, such as Norway’s DNO, even though they struggled to collect profits.

But at the 11th hour, industry sources say, Royal Dutch Shell backed out and decided to focus on a $17 billion gas deal in the south rather than sign exploration contracts with the Kurdish Regional Government, which the central government could dismiss as illegal and could prompt reprisals.

Shell’s caution, Exxon’s silence on its deals and this week’s renewed dispute between Baghdad and Kurdistan over export payments reveal how delicate is the balance companies must manage between a central government and a Kurdish authority locked in a struggle over who controls Iraq’s vast oil wealth.

The dispute over oil is at the heart of a wider disagreement between Iraq’s central government in Baghdad and the Kurdish region, which are also increasingly at odds over regional autonomy, land and political influence.

Iraq has ambitious plans to develop its huge southern oilfields – potentially the world’s biggest source of new oil over the next few years – and few oil firms dare risk being barred from such a bonanza by angering Baghdad.

But increasingly, some executives say, Kurdistan’s potential is also coming up in boardroom discussions, as sluggish output, red tape and infrastructure bottlenecks in the south take some of the shine off the central government’s oil program.

Oil majors are now waiting on the sidelines, watching the outcome of Exxon’s balancing act between Baghdad and Arbil, the northern capital. France’s Total is the latest company to provoke Baghdad’s ire by acknowledging interest in Kurdistan.

“What companies are trying to do is get to the point where they are investing in the north and the south,” said one industry source working in Iraq. “But at the moment they cannot do that. And that is what you have to build in when you decide whether to move in or not. You balance the risks.”

After decades of war and sanctions, Iraq has signed multi-billion dollar agreements with Exxon, Shell and BP to develop fields in the south where most of its crude is pumped, hoping to become a major global oil exporter with output targets of around 8-8.5 million bpd.

But two years on, only modest gains have so far been notched up in production by companies frustrated by infrastructure constraints, payment disputes and logistical hurdles. Output last year averaged 2.7 million barrels per day versus about 2.4 million bpd in 2009, the year of Iraq’s oil tenders.

The government in Baghdad has driven a tough bargain with foreign companies, offering fee-for-service contracts with tightly controlled profit margins and little chance to benefit from high energy prices.

Firms have experienced problems getting visas for contractors and security staff, delays in bringing in armored vehicles and holdups securing operating licenses. Such hassles make Kurdistan’s offerings look more tempting by comparison.

“Every delay we face cuts off a significant part of the internal rate of return,” said one oil company source. “Sometimes I wonder if we picked the wrong region.”

This year Norway’s Statoil became the first major company to abandon one of Iraq’s lucrative new oil deals, selling its stake in West Qurna Phase-2 field to Lukoil.

POLITICAL CRISIS

The renewed stand-off between Baghdad and Arbil over oil is playing out against the background of a political crisis in Baghdad that jeopardized the shaky power-sharing agreement intended to prevent a return to ethnic and sectarian warfare.

Prime Minister Nuri al-Maliki, a Shi’ite, heads a coalition that also includes Kurds and Sunnis. Just as the last U.S. troops left the country in December, Maliki’s government issued an arrest warrant for the country’s most senior Sunni Arab politician, Vice President Tareq al-Hashemi.

Hashemi fled to the Kurdish region, and Kurdish regional President Masoud Barzani refused to turn him over for trial, infuriating Baghdad.

Barzani has since given speeches increasingly antagonistic to a central government he says is trying to undermine Kurdish autonomy. He has accused Maliki of concentrating power in his own hands, and has warned in vague terms that Kurdistan may reconsider its relations with Baghdad.

Iraq’s central government is also being challenged by other regions like oil hub Basra in the south and Sunni-dominated Anbar who see Kurdistan’s autonomous status as a model for their own drives for more freedom from Baghdad’s control.

Autonomous since 1991, Iraqi Kurdistan runs its own internal government and armed forces, and escaped the sectarian warfare that saw the rest of Iraq hit by suicide attacks and car bombs since the 2003 U.S.-led invasion.

Kurdistan’s stability proved an attractive draw to oil explorers, and its government has offered production-sharing deals, which allow firms to profit directly from oil sales rather than just taking a negotiated fee for their work.

Small and medium-sized companies like DNO, British oil company Afren, Gulf Keystone Petroleum and Canada’s Talisman Energy, are pushing ahead with exploration in Kurdish oilfields.

Peter Wells of geological consultancy Neftex Petroleum said Baghdad’s service contracts make sense for developing existing, discovered oilfields with only small technical risk attached. Arbil’s production-sharing contracts encourage exploration, by offering greater potential gains for greater risk.

Big Oil prefers the production sharing deals, which let firms count reserves on their books, make more money per barrel and gain if the oil price rises. They get operational control and an easily tradeable asset.

“Put it this way: they want us in Kurdistan,” says one oil executive. “But it doesn’t feel that way in the south.”

CATALYST FOR ACCORD

But however attractive Kurdistan may seem, companies operating there face one fundamental challenge: getting paid.

The Kurds receive 17 percent of Iraq’s total oil export revenue – a huge sum that has fuelled an economic boom in the region – but in return, Kurdish oil can be legally exported only by the central government.

As long as the legal status of Kurdish oil deals is disputed in Baghdad, companies operating in Kurdistan have had no way to bring oil to market and collect a profit.

Under the Iraqi constitution, the central and regional governments should work together on ways to manage oil and gas reserves and distribute revenues. But Kurdish and Arab lawmakers in Baghdad have been at loggerheads for years over an oil and gas law to sort those issues out.

Exports from the north to a pipeline through Turkey began flowing last year under an interim agreement. Baghdad promised to collect revenue and pay companies their costs, leaving the question of firms’ profits to be decided later.

But Baghdad and Arbil argued from the outset over how much oil was being pumped and how much money was owed.

This week, Kurdistan said it had halted those exports because Baghdad had failed to pay the companies for their oil. Iraqi government officials said Kurdistan was failing to meet its export obligations and illegally smuggling oil abroad.

Oil firms may have hoped that Exxon’s push into Kurdistan would act as a catalyst to force the two sides to work together and enact an oil law. But for now, the increasingly shrill rhetoric on both sides hardly inspires confidence that a solution is growing closer.

When Kurdistan’s government announced last year that Exxon had agreed to exploration deals for six Kurdish fields, Baghdad responded with outrage. Deputy Prime Minister Hussain al-Shahristani – architect of Baghdad’s oil program – said the U.S. firm could forfeit the contract on its huge West Qurna-1 oilfield in the south if it did not halt work with the Kurds.

Baghdad has since barred Exxon from bidding in the next round of oil deals, although it says the decision is not final. Exxon was also removed from its lead role in a water injection project in the south, although Iraqi officials denied the move was linked to the Kurdish deal.

The central government now says that Exxon has written to it twice since early March to say that its deals with the Kurds have been suspended. The Kurds say Exxon has not halted work in Kurdistan and have challenged Baghdad to publish Exxon’s letters.

Total has become the second supermajor to say it is considering investing in Kurdistan, although it has not yet announced deals there. Chief executive Christophe de Margerie, long a critic of Iraq’s service contracts, said Total will not seek deals in the central government’s next bidding round.

The conditions on offer from Baghdad, he says, are not attractive enough.

Story here.—————————————————————

Iraq Warns Kurds Against Striking Oil Deal With Turkey

By Palash R. Ghosh

Monday, May 21, 2012

The central government of Iraq warned the Kurdish-ruled semi-autonomous region of northern Iraq that it must obtain Baghdad’s approval for any oil export deals signed with Turkey.

On Sunday, Iraqi Kurdistan unveiled an agreement to sell oil through Turkey into the international markets, thereby leaving Baghdad completely out of the loop. The Kurdish oil minister Ashti Hawrami said Iraqi Kurdistan will construct a huge 1 million barrel per day pipeline over the next 12 months through which oil and gas will be carried through Turkey.

“We envisage the building of a new pipeline taking Kurdistan’s oil, particularly the heavier component part to Cihan,” Hawrami said at a conference with Taner Yildez, the Turkish energy minister.

Baghdad believes such an arrangement contravenes Iraqi laws, while Kurds assert they can sign any contract regarding their natural resources according to the terms of the constitution.

Since 2003, the Kurds have entered into dozens of gas and oil deals, all of which have been classified as “illegal” by the authorities in Baghdad, who have also blacklisted the companies involved, including Exxon Mobil Corp. (NYSE: XOM), from doing business in Iraq’s southern oilfields.

“We have no problem with any deals, but they have to be according to the Iraqi constitution and laws that govern relations between Baghdad and the Kurdish region,” said Ali al-Moussawi, an adviser to Iraqi Prime Minister Nouri al-Maliki.

Earlier, the Kurds and the central Iraqi government entered into a deal under which Kurdistan would transport its oil to Baghdad, which would then sell it on the international market (with each side taking half of the revenue). However, in April, the Kurds cancelled this agreement, citing a payment dispute with Baghdad.

But Hawrami insisted that there is no distinction between Kurdish oil and Iraq oil.

“When we say oil from Kurdistan, it’s Iraqi oil,” Hawrami said.

“There is no difference between Iraqi oil or Basra oil from Kurdistan.”

A pact between Iraqi Kurdistan and Turkey was inevitable.

“If you look at Turkey, which is the second-fastest-growing country in the world, its gas needs, which increase significantly every year, and then the price of oil, I think people realize that Turkey is looking to Iraq — particularly the Kurdish regional government — very carefully, because of economics, not because of politics,” Mehmet Sepil, chairman of Turkey’s Genel Energy, told al-Jazeera.

Iraq is now Turkey’s second-biggest trade partner, although most of that trade is with the Kurdish region.

According to the Kurdish government, there are about 143 billion barrels of proven oil reserves in the south of Iraq, while the northern (Kurdish) semi-autonomous region has about 45 billion barrels,.

Meanwhile, any deals with Turkey will likely worsen already tense relations between Ankara and Baghdad.?Maliki of Baghdad was also outraged recently when Turkey’s Prime Minister Recep Tayyip Erdogan hosted Tariq al-Hashemi, the Iraqi vice president who had been issued an arrest warrant by Baghdad for allegedly forming death squads. Hashemi has since escaped to Iraqi Kurdistan for refuge.

Story here.—————————————————————-

Al Nujaifi: Turkey is Mosul’s gate to the worldHASAN KANBOLAT

01 May 2012, Tuesday….The distance between Arbil, the capital of the Kurdistan Regional Government (KRG), and Mosul is a one-hour drive. The KRG relies on the advantage of being a federal region. Welfare, prosperity, stability and foreign capital… The semi-autonomous Kurdish region receives 17 percent of the oil revenues of Iraq. The number of Turkish firms has exceeded 2,500 in the region. Mosul, on the other hand, the second-largest city of Iraq after Baghdad, is far away from its glorious past. It is unable to deal with poverty. It fails to attract foreign capital. In comparison to the Kurdish region, the number of Turkish firms is just 11.

Mosul is an agricultural and oil region. However, it cannot properly and sufficiently use Iraq’s oil revenues. Mosul is also uncomfortable with the recent agreements between foreign oil companies and Arbil to extract oil from Mosul’s soil. For instance, Exxon-Mobil signed a contract with the KRG despite the fact that the site it will explore for oil is in Mosul. Nujaifi is holding talks with Exxon-Mobil and the KRG to resolve this problem. In addition, under the Iraqi constitution, Mosul should get 11 percent of Iraq’s oil revenue. However, it receives only 2 percent. According to Nujaifi, if the oil bill is not adopted and the oil revenues are not distributed evenly by the provinces, a political crisis will erupt. The poverty rate in Mosul is 23 percent, whereas it is 3 percent in the KRG. Nujaifi notes that the rising tension along the borders of Mosul is creating tension for them as well. As the KRG becomes more popular, it is impossible to explain the recent state of backwardness in Mosul.

Story here.

I spent 2 months up there around the start of the year doing recces for another big oil services company. The general feeling was that they could make a lot more money up there than down south with less red tape and hassle from the police and MoI. Its a much nicer safer place to work as well which is a big bonus.

Comment by barrybudden — Thursday, May 24, 2012 @ 2:17 AM

I spent 2 months up there around the start of the year doing recces for another big oil services company. The general feeling was that they could make a lot more money up there than down south with less red tape and hassle from the police and MoI. Its a much nicer safer place to work as well which is a big bonus.

Comment by feraljundi — Saturday, February 2, 2013 @ 11:07 AM